10 Questions to Ask Your Hard Money Lender

If you’re looking to use hard money to finance an investment property, it’s important to gather as much information as possible before going through with the loan. That said, you’ll likely have several questions to ask your lender. If you don’t, this article is for you. Today, we’ll go over what to look for in a lender and ten essential questions you’ll want to ask your hard money lender. Read along to learn how to find the right lender for your next investment.

Contents of This Article:

- An Overview of Hard Money Loans

- What to Look for in a Hard Money Lender

- 10 Essential Questions for Your Hard Money Lender

- Additional Questions You May Want to Ask

- Find the Right Lender for Your Investment Today

An Overview of Hard Money Loans

Hard money loans are an alternative option to traditional real estate financing, like mortgage loans. Unlike mortgage loans that are offered by banks or lending institutions, hard money loans are provided by private individuals or companies. Additionally, these loans are secured by the value of a real estate investment rather than the borrower’s creditworthiness.

If you’re looking to secure a time-sensitive real estate deal, hard money loans are great, as Baltimore hard money lenders can approve and fund your request quickly. However, while they offer flexibility in repayment terms, they typically come with higher interest rates and may be riskier for borrowers. After all, with your investment property as collateral, you risk losing it if you’re unable to repay the loan.

What to Look for in a Hard Money Lender

If you’re looking for a hard money lender, you’ll want to ensure they’re experienced and reliable. For instance, you’ll want to look into their reputation in the industry and previous projects they’ve funded. It may be helpful to reach out to references or other borrowers who have worked with them before.

During your research, look for transparency regarding interest rates, fees, and loan terms. Additionally, assess the lender’s flexibility in repayment structures and their ability to fund quickly, which is typically a crucial factor in time-sensitive real estate transactions.

Before working with a lender, verifying their legal compliance and licensing is critical. After all, you’ll want to ensure you’re working with a reliable, licensed lender who can help you achieve your goals. Next, we’ll go over some essential questions to ask your hard money lender before working with them.

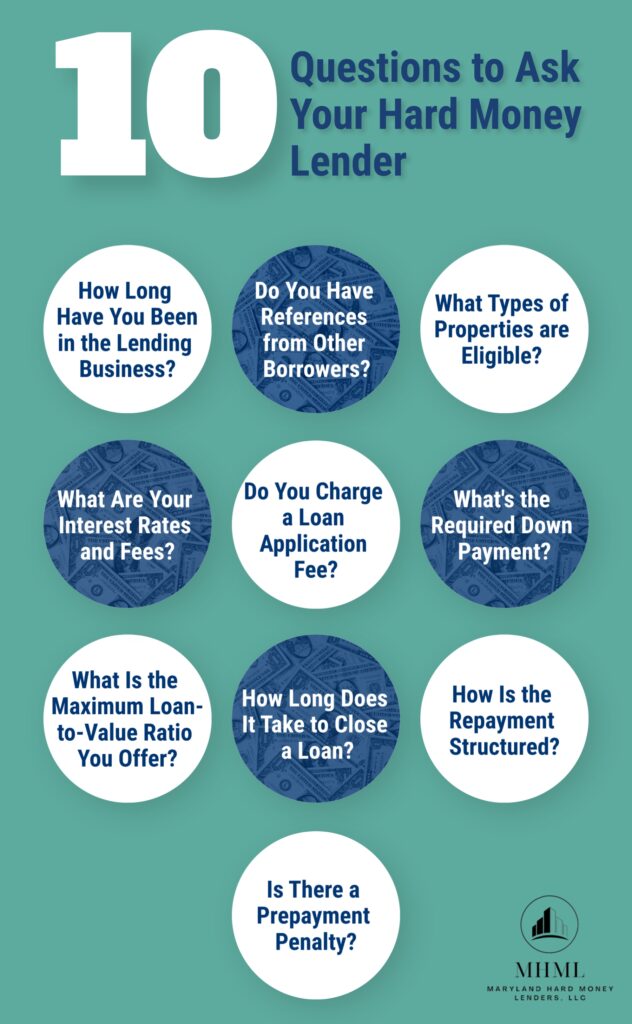

10 Essential Questions for Your Hard Money Lender

When working with a hard money lender, it’s crucial to gather as much information as you can to make an informed decision. Additionally, you’ll want to ensure you qualify for the loan and that it will meet your investment needs and goals. Here are ten essential questions to ask your hard money lender before going through with a loan.

- How Long Have You Been in the Lending Business?

- Do You Have References from Other Borrowers?

- What Types of Properties are Eligible?

- What Are Your Interest Rates and Fees?

- Do You Charge a Loan Application Fee?

- What’s the Required Down Payment?

- What Is the Maximum Loan-to-Value Ratio You Offer?

- How Long Does It Take to Close a Loan?

- How Is the Repayment Structured?

- Is there a Prepayment Penalty?

How Long Have You Been in the Lending Business?

Understanding the lender’s experience provides insight into their industry knowledge and credibility. That said, you’ll want to look for a lender with a proven track record to ensure they’re reliable and have adequate experience in the lending business.

Do You Have References from Other Borrowers?

Requesting references allows you to hear about other people’s experiences with the lender. Of course, you’ll want to look for positive references and good reviews from previous borrowers. This can help you better understand their credibility and reliability to ensure they can meet your needs effectively.

What Types of Properties are Eligible?

Different lenders may have preferences or restrictions on property types. For instance, some lenders specialize in fix-and-flip loans or new construction loans, while others may work with rental property investments. Clarifying the types of properties eligible for financing ensures that your investment aligns with the lender’s criteria.

What Are Your Interest Rates and Fees?

Each lender differs when it comes to interest rates and fees. However, most hard money lender’s interest rates range from 10% to 18%. Additionally, they could charge origination fees, underwriting fees, loan servicing fees, or points. So, it’s important to be aware of any fees to evaluate the cost of borrowing. Compare these figures across lenders to ensure competitive and reasonable terms.

Do You Charge a Loan Application Fee?

Before applying for a loan, you’ll want to inquire about any application fees. Some lenders charge a fee just for applying, while others do not. This will help you understand the upfront costs involved with the loan. Being aware of any fees associated with the loan application process can help you budget accordingly.

What’s the Required Down Payment?

Different lenders may have varying down payment requirements. Understanding the required down payment is crucial for budgeting and determining your financial commitment to the loan.

What Is the Maximum Loan-to-Value Ratio You Offer?

The loan-to-value (LTV) ratio represents how much money the lender is willing to provide compared to the value of the property used as collateral. Typically, lenders will lend around 50% to 70% of the property’s value. However, it depends on the lender and their specific terms, so it’s crucial to ask before going through with a loan.

How Long Does It Take to Close a Loan?

The timeframe for loan closure is vital, especially for time-sensitive projects. A quicker closing process may be beneficial for certain investments, so it’s important to align expectations. If you’re looking to close a deal quickly, finding a lender that can fund your loan as soon as possible is critical.

How Is the Repayment Structured?

Understanding how loan repayment is structured can help you plan for future financial obligations. As such, you’ll want to clarify whether the repayment includes interest-only payments, principal payments, or a combination of both.

Is There a Prepayment Penalty?

Some lenders charge prepayment penalties for early repayment, while others do not. So, you’ll want to inquire about prepayment penalties to evaluate the flexibility in loan repayment. Understanding all potential costs or penalties can help you make informed decisions about your loan choice.

Additional Questions You May Want to Ask

Feel like you have more questions for your lender? It’s important to ask them right away to avoid wasting time with a lender who won’t be a good fit for your situation. Here are some additional questions you may have.

- Are there any hidden costs I should be aware of?

- What criteria do you use to evaluate loan applications?

- How much emphasis is placed on the borrower’s credit history?

- Can I extend the loan if needed?

- Is there room for negotiation or alternative solutions in case of financial challenges?

- Are there more favorable terms for experienced investors?

- How do you determine the value of the property?

- Are payments interest-only, or are there principal payments as well?

- Are there any restrictions on the condition of the property?

- What steps do you take in the event of a loan default?

Find the Right Lender for Your Investment Today

If you’re looking to finance your next investment with a hard money loan, it’s important to do your due diligence. You’ll want to ask your hard money lender several questions to ensure you’re both on the same page. Remember, there are never “too many” questions when it comes to financing your real estate investment. The more information you get, the better.

Need to quickly finance an investment property near Maryland? Maryland Hard Money Lenders can help. Our team of experts can ensure you get your loan smoothly and securely when you need it. Fill out our initial loan application or contact us today to learn more about our lending business!