Hard Money Loan Application Process: A Step-by-Step Guide

Finding the right loan for your real estate investment can be challenging, especially if you don’t qualify for traditional financing. Luckily, hard money loans come in handy for many investors who need to secure a deal quickly or don’t qualify for a traditional mortgage loan. With a simple loan application process and fast approval, hard money loans can help you get the necessary funds. Read along to learn about hard money loans and the loan application process.

Contents of This Article:

- How Hard Money Loans Work

- What Is the Hard Money Loan Process?

- What You’ll Need for the Loan Application Process

- Importance of Finding a Reputable Lender

How Hard Money Loans Work

Hard money loans are short-term, asset-based loans typically used for real estate investments. They’re typically funded by private investors or lending companies rather than traditional banks. So, people not qualifying for a conventional mortgage loan may look to a hard money loan instead. However, it’s important to note that hard money loans work differently than normal bank loans.

First, the loan application process differs from traditional and hard money loans. Most banks and traditional lenders base loans on your credit score and financial history. However, Baltimore hard money lenders look at the property you want to buy as it serves as collateral for the loan. Additionally, hard money loans have shorter loan terms, usually ranging from a few months to a few years. As such, hard money loans are a great choice for fix-and-flip projects, rentals, or other investment properties.

Hard money loans also differ from traditional loans when it comes to interest rates and fees. Hard money loans often come with higher interest rates than conventional ones since they involve more risk for the lender. Additionally, borrowers often pay additional fees, or “points,” which are a percentage of the loan amount.

If you’re looking to get a hard money loan for your next investment, it’s important to learn what you’ll need for the loan application process. That way, you can come prepared and potentially get funded even faster.

What Is the Hard Money Loan Application Process?

The loan application process for a hard money loan is generally faster and more straightforward than traditional bank loans. However, it still involves several crucial steps. Here’s an overview of the typical hard money loan application process.

- Find a Local Lender- If you’re looking to get a hard money loan, start by researching and identifying potential lenders or lending companies. Look for someone with a good reputation that specializes in the type of loan you need.

- Submit a Loan Application- Contact the selected lender or lending company and complete a loan application. The application typically asks for basic information about you and the property.

- Provide Property Information- You’ll need to provide detailed information about the property that will serve as collateral for the loan. This includes property type, address, photos, property value estimates, and any other relevant documents.

- Property Evaluation- The lender will assess the property’s value and condition to determine the loan-to-value (LTV) ratio. The LTV ratio is the loan amount relative to the property’s appraised value.

- Review Offer and Terms- If the lender determines that the loan and property meet their criteria, they’ll present you with a loan offer. Be sure to carefully review and understand the terms before accepting the offer. For instance, look over the loan amount, interest rate, points, fees, and repayment terms.

- Loan Approval and Closing- If everything checks out and the lender is satisfied with the deal, they’ll approve the loan. The closing process will involve signing the loan documents and getting insurance for the property.

What You’ll Need for Your Loan Application Process

Depending on which hard money loan company you go with, the information you’ll need for the loan application process may differ. However, if you go with Maryland Hard Money Lenders, the initial loan application is simple and easy to understand.

Like most hard money loan companies, you’ll need to fill out a loan application with some basic information before a loan is funded. It’ll include your name, email, phone number, the purpose of the loan, and the subject property address. Additionally, you’ll be asked questions like:

- Is this your primary residence?

- Are you in foreclosure?

- Are you in bankruptcy?

- What is your credit score?

Then, you’ll want to fill out your requested loan amount, the purchase price of the property, the current value of the property, the estimated value after rehab, and estimated repair costs.

You may be asked additional questions, such as:

- Do you have any current loans on the subject property?

- Have you ever gotten a hard money loan before?

- Do you have any other hard money loans?

As long as you provided all the necessary information on your loan application, you should quickly hear back from a lender. Then, once you’ve been approved, you’ll need to provide several documents regarding your income and plans with the property.

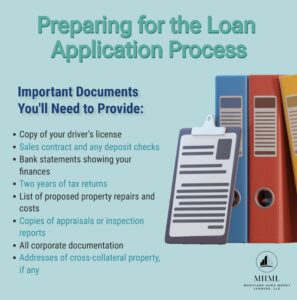

Documents You’ll Need

- Copy of your driver’s license

- Sales contract and any deposit checks

- Bank statements showing your finances

- Two years of tax returns

- List of proposed property repairs and costs

- Copies of appraisals or inspection reports

- All corporate documentation

- Addresses of cross-collateral property, if any

Once you’ve submitted all the necessary documentation, your lender will help you set up an inspection, get the right insurance, and access your loan funds.

Importance of Finding a Reputable Lender

Finding the right financing for your real estate purchase can be challenging–especially if you struggle to meet the qualifications for a traditional loan. As such, you may consider looking into the hard money loan process to access funds and purchase real estate quickly.

However, if you’re looking for an alternative financing method, working with reputable lenders is important. But how do you find them? Start by looking locally.

Maryland Hard Money Lenders have the knowledge and expertise to help you secure real estate quickly. As long as you have the right information and fill out a loan application to the best of your ability, we can help fund a loan within 48 hours. So, contact Maryland Hard Money Lenders today to learn more about our lending process and requirements.