Common Misconceptions About Hard Money Loans

As with any financial decision, it’s crucial to conduct thorough research, learn from professionals, and carefully evaluate the terms and conditions of a loan before proceeding. Unfortunately, some common misconceptions about hard money loans lead people to believe in misinformation. Today, we’re here to debunk these common myths and learn how to move past them. Read along to learn more about hard money loans.

Contents of This Article:

- Why Are There Misconceptions About Hard Money?

- Myths and Misconceptions About Hard Money Loans

- Moving Past the Myths and Misconceptions

- Learn More From a Trusted Local Lender Today

Why Are There Misconceptions About Hard Money?

Hard money loans are often misunderstood by investors and potential borrowers. Due to a lack of knowledge and research, many people mistakenly believe the misconceptions they hear about these types of real estate loans in Maryland. The first step to debunking some of the common misconceptions about hard money is learning why they exist.

- Lack of Awareness- Hard money lending is a niche within the lending industry, so not everyone may be familiar with its concepts and practices. As a result, there may be a lack of awareness or understanding about how hard money works, leading to misconceptions.

- Limited Availability- Hard money loans are typically provided by private individuals or small lending firms rather than traditional banks or financial institutions. As such, the limited availability and visibility can contribute to misconceptions. Inadequate experience or knowledge enough about hard money loans can lead to misunderstandings.

- Higher Interest Rates- Hard money loans often come with higher interest rates compared to traditional loans. This is because lenders typically take on higher risks by providing loans based on collateral rather than the borrower’s creditworthiness. In turn, the perception of high interest can contribute to misconceptions about hard money being predatory.

- Association With Investing- Typically, hard money loans are used in real estate investing, particularly for fix-and-flip projects or property investments with a quick turnaround. As such, the association with real estate may lead to misconceptions that hard money only works for real estate investors or is inherently risky.

- Negative Experiences- There may be instances where unethical practices or lenders exist within the hard money lending space. Negative experiences or stories of borrowers who’ve had unfavorable encounters can create misconceptions and create a biased view of hard money lending.

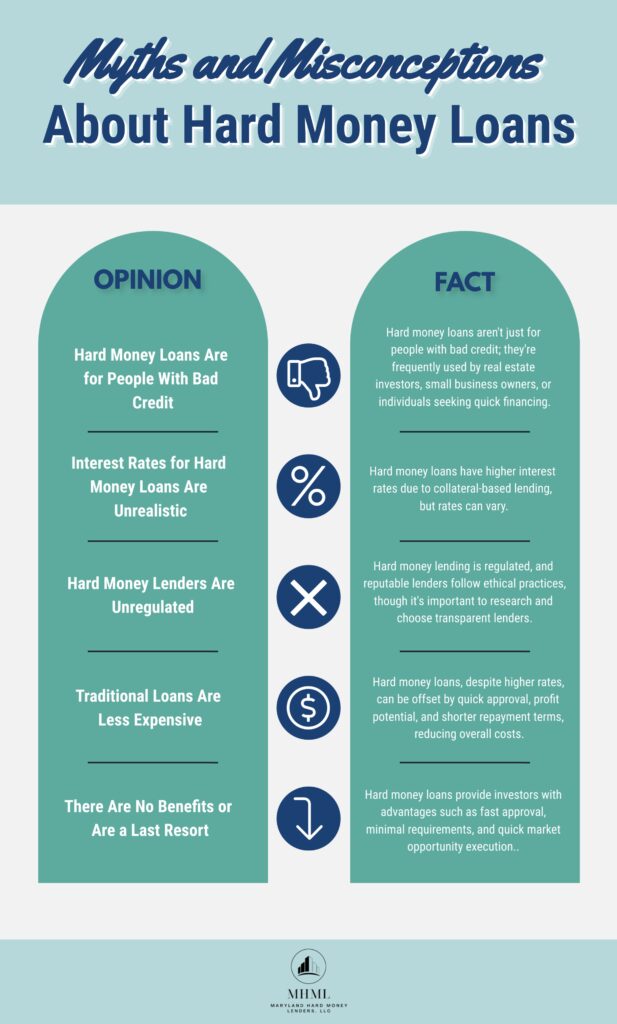

Myths and Misconceptions About Hard Money Loans

Individuals that don’t understand or have experience with hard money loans may view them as risky, expensive, or untrustworthy. However, we’re here to debunk these myths and learn more about hard money loans. Here are some of the most common myths and misconceptions regarding these types of loans.

Hard Money Loans Are for People With Bad Credit

One of the common misconceptions about hard money loans is that they’re only available to individuals with poor credit. However, while hard money lenders focus more on collateral rather than credit scores, they’re not exclusively for borrowers with bad credit. Instead, real estate investors, small business owners, or individuals who need quick financing often use them.

Interest Rates for Hard Money Loans Are Unrealistic

It’s true that hard money loans generally have higher interest rates compared to traditional bank loans. However, the rates reflect the increased risk lenders take, as they provide based on collateral rather than creditworthiness. That said, interest rates can vary depending on factors such as the lender, loan term, and borrower’s circumstances.

Hard Money Lenders Are Unregulated

Another misconception is that hard money lenders operate unregulated or predatory. However, hard money lending is subject to various regulations depending on the jurisdiction. Additionally, reputable hard money lenders adhere to ethical lending practices and operate within legal frameworks. That said, as with any industry, it’s crucial to research and choose reputable lenders who are transparent about their terms and conditions.

Traditional Loans Are Less Expensive

While hard money loans have higher interest rates, that doesn’t mean they’re more expensive than traditional ones. After all, time is money–so it’s important to consider the speed of approval and the ability to take advantage of investment opportunities. For instance, if an investor can quickly flip a property for profit, the profits may be able to offset the loan cost. Additionally, shorter repayment terms for hard money loans can make them more affordable, as interest accrues over a shorter time period.

There Are No Benefits or Are a Last Resort

Some individuals view hard money loans as a last resort when traditional financing options are available. However, hard money loans have distinct advantages for investors. For instance, they offer fast approval and funding, have fewer requirements, and can be obtained without a lengthy documentation process. Additionally, hard money loans can provide opportunities for investors to secure deals or take advantage of market opportunities quickly.

Moving Past the Myths and Misconceptions

Don’t let the common misconceptions about hard money loans stop you from exploring the benefits. If you’re an investor looking for fast financing and fewer loan requirements, consider looking into hard money loans. Here are some of the ways investors can move past the myths and learn more about hard money.

- Research Hard Money Loans- If you’re looking to buy real estate with a hard money loan, invest time in researching and understanding the fundamentals. Look for reputable sources or talk with industry professionals to learn more about hard money.

- Find References and Testimonials- Look for references or testimonials from investors who have successfully used hard money loans. Learning firsthand experiences can provide valuable insights, debunk myths, and help investors understand the benefits of hard money.

- Seek Advice From Professionals- Engaging with professionals with hard money lending experience can be incredibly valuable. Consider consulting with real estate agents, mortgage brokers, financial advisors, or attorneys specializing in real estate transactions.

- Build Relationships With Lenders- Establishing connections with reputable hard money lenders is crucial. Investors can find trustworthy professionals who adhere to ethical lending practices by researching lenders.

- Review Loan Terms Carefully- Investors must thoroughly review the terms and conditions of any hard money loan they consider. This includes understanding interest rates, fees, repayment terms, and other contractual obligations. Carefully reading the loan documents can help make more informed decisions and avoid surprises or misunderstandings.

- Evaluate the Risk-Reward Ratio- Investors should assess the risk-reward ratio associated with hard money loans based on their investment goals and risk tolerance. Understanding the potential benefits and drawbacks and conducting proper due diligence can help investors make better decisions and minimize risks.

Learn More From a Trusted Local Lender Today

If you’re thinking about getting a hard money loan, it’s important to learn about the common misconceptions and the truth about them first. That way, you can make informed leading decisions that align with your investment goals.

Don’t hesitate to contact one of our dedicated professionals at Maryland Hard Money Lenders. We can help you understand your loan obligations, responsibilities and how you can succeed with a hard money loan. Contact us to learn more, or fill out a hard money loan application today.